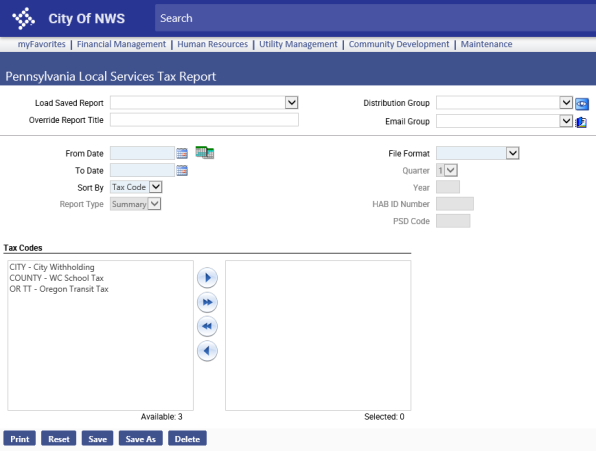

Pennsylvania Local Services Tax Report

Human Resources > State Requirements > PA > Local Services Tax Report

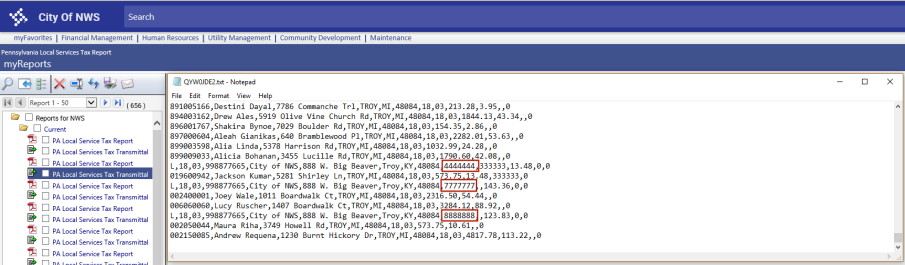

The ![]() Local Services Tax Report has been added to the Pennsylvania State Requirements menu. Previously run from the Pennsylvania Local Quarterly Tax Report page, this report has been upgraded to support reporting for multiple employers.

Local Services Tax Report has been added to the Pennsylvania State Requirements menu. Previously run from the Pennsylvania Local Quarterly Tax Report page, this report has been upgraded to support reporting for multiple employers.

Each time you run the report, the transmittal file is created automatically with the PDF.

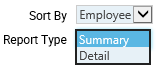

The ![]() Sort By drop-down gives you the option to sort the PDF by Tax Code or Employee. Tax Code is selected by default.

Sort By drop-down gives you the option to sort the PDF by Tax Code or Employee. Tax Code is selected by default.

Selecting to sort the PDF by Employee enables the ![]() Report Type drop-down, giving you the option to generate a Summary or Detail PDF.

Report Type drop-down, giving you the option to generate a Summary or Detail PDF.

Note: The Sort By and Report Type selections do not affect the transmittal file; they affect the PDF report only.

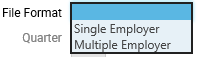

The ![]() File Format drop-down gives you the option to run the report and transmittal for one or multiple employers. Selecting Multiple Employer enables the Quarter, Year, HAB ID Number and PSD Code fields.

File Format drop-down gives you the option to run the report and transmittal for one or multiple employers. Selecting Multiple Employer enables the Quarter, Year, HAB ID Number and PSD Code fields.

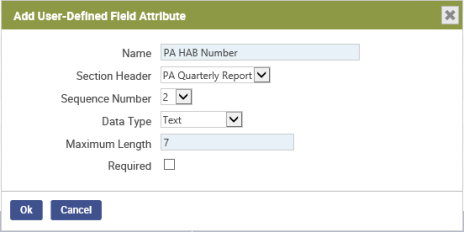

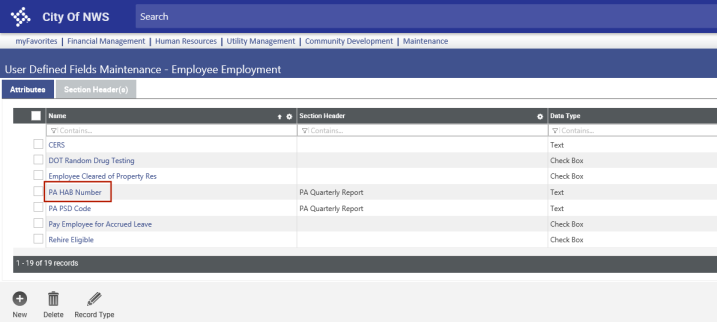

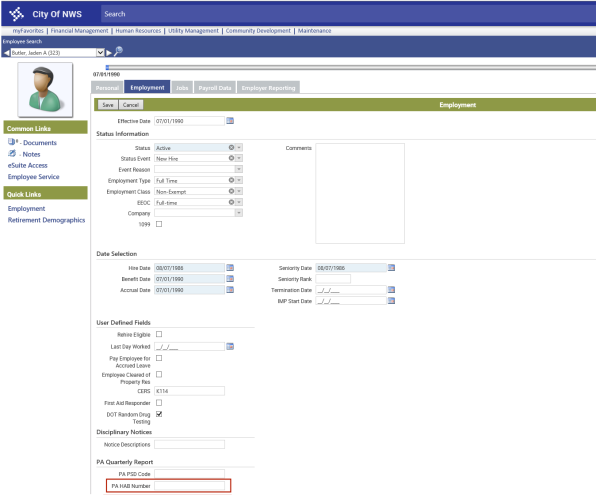

The HAB ID Number selected on this page is the default and will appear in the header record of the transmittal file; however, a new user-defined field (UDF), PA HAB Number, for the Employment tab in Workforce Administration lets you override the default with other HAB IDs entered for selected employees. These IDs also appear in header records in the transmittal file. If the HAB ID is blank on an employee's Employment tab, the transmittal uses the ID selected here. Click ![]() here for the steps to set up the PA HAB Number UDF.

here for the steps to set up the PA HAB Number UDF.

From the Available Tax Codes list box, select the tax codes you want reported and move them to the Selected ![]() list box.

list box.